Patients are about to be targeted like never before by advertising companies as face recognition software merges with information screens to profile your interests as you wait for your doctor.

Lord Sugar is on the verge of selecting one more hard-nosed apprentice to his entrepreneurial stable as his Apprentice programme reaches its latest conclusion this Wednesday. Quite what work the eventual winner will undertake is unclear but a previous winner was selectedto run the sales of a project that profiles patients in the NHS as they sit and wait for their GP.

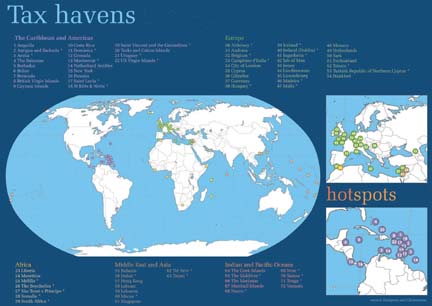

Amscreen Plc is part of Lord Sugar’s Amshold Group of companies, which is basedin the tax haven of Jersey and is overseen by his son Simon Sugar, who is the CEO. The company, which launched in 2008 when Lord Sugar bought Comtech M2M, provides T.V screens into places where there is a captive audience and places targeted marketing alongside the other content the organisation may use. These screens are placedin GP surgeries, hospitals and dentists throughout the UK and in Europe and also in petrol stations, convenience stores.

The way it works is like this. Amscreen will place a screen for free in say a GP surgery, which allows the surgery to inform patients on matters such as surgery opening hours or flu jab reminders. The money they get is by selling the other space on the screen to advertisers which will be part of a pre-packaged programme that will reach the captive audience waiting to be seen by their doctor.

Amscreen distributes its screens in two main ways: by either funding the screen and installation at a client's premises, allocating some airtime to that client alongside the preloaded advertising, or by selling screens to a client and enabling them to control their own media network (in return for a small monthly fee) where they have 100% control of the ad content.

Amscreen health has expanded their operation so that around 850 screens now exist in 695 GP surgeries, Pharmacies, Hospitals, and Dentists. Amscreen offer various packages depending on their target audiences, which are tailored towards over 55s, health charities, mother & baby, pharmaceuticals and private health. Amscreen is mainly in the UK, but is expanding into Europe and around the world.

In partnership

Three years ago, Amscreen and private hospital group, BMI Healthcare agreed a two-year partnership, which involved BMI Healthcare providing live weatherfeeds to advise patients on their ‘healthcare choice’. Quite how many meteorologists exist within the hospital network is unclear, but what is known is that this platform also allowed for the company to reach out to millions of patients advertising their services.

Nigel Moon, the Head of Marketing at BMI Healthcare said at the time “This advertising and sponsorship package provides us with a great opportunity to feature BMI Healthcare, our local hospitals and services to a highly targeted audience at a key time in the patient journey.” BMI Healthcare are just one of many other private health companies listed as ‘established relationships’, which include Baxter, GSK and Pfizer and Bayer healthcare, who are able to reach captive audiences in GP surgeries across the healthcare network. Apart from the healthcare corporates regularly cited on Amscreen's website, Care UK and Bupa have also been clients.

However, take up of the Amscreen product has not been as successful as he would like. In an interview with marketing company 'Campaign Live', Lord Sugar said ‘I don’t get them…I don’t understand why these people don’t say: ‘Bloody hell, I’ve got a captive audience of hypos [hypochondriacs] sitting there and I’ll bang my Anadin vs Panadol [messaging] on the screens non-stop’. The Labour Peer, according to the marketing website believes ‘all over-the-counter drugs should use Amscreen’s screens in health environments.’ This method according to their own material, will drive an 'uplift in prescriptions.'

Face recognition

In order to improve the sales of Amscreen, the company has now teamed up with a face recognition company called Quividi. This technologywill be able to ‘determine the gender, age, date, time and volume of the viewers’ that look at the adverts and give real-time feedback to the advertisers. Lord Sugar’s son Simon reckons “brands deserve to know not just an estimation of how many eyeballs are viewing their adverts, but who they are, too.”

Alan Sugar, who was given his peerage in 2009, is a Lord largely in name only. In the last year he has taken part in 3 debates and has voted in 3.74% of votes, which given his outside interests is unsurprising. In addition when Lord Rea put forward a motion to shelve the Health and Social Care bill, Mr Sugar didn’t bother to turn up. However, he is of use to the Labour party who have gladly received £333,650.84 in donations from the ‘noble’ peer since 2001.

Privacy

Patients are surely entitled to be able to enter a GP surgery without being targeted by advertisers. Patients largely trust their GP and if drugs appear on the screen in front of them, then they may think that the GPs had control over the content. This is certainly recognised by Amscreen who explicitly say the positioning of advertising in a GP surgery is a ‘perceived endorsement’ of a product by the GP.

The idea that you will be having your face analysed by advertisers as you sit waiting for your Doctor is surely an invasion of your privacy, despite assurances that faces are detected rather than captured. Many people going into the GP will presumably be concerned over their health, which is a matter not overlooked by Amscreen. In their promotion materialit points out ‘Our high impact screens will provide advertisers with an opportunity to communicate with a broad audience in a receptive mind-set when mental and physical wellbeing for themselves, their families and the community is top of mind.’

Breach of Trust

This all means that a patient without their knowledge or permission is providing information for free to advertisers in the perceived trusted environment of their surgery. Although other important information is imparted on the screens, the local surgery is acting in partnership with whoever the advertisers happen to be over the contractual period. All this amounts to a situation in which patients are being taken advantage of in a vulnerable moment, which is a clear breach of trust by the GP surgery, hospital or dentist, whether privately run or NHS. Such a practice should stop and if you see a screen when you're waiting for your appointment next, then you may need to assume you're being watched.